Ketamine infusion therapy, while effective for conditions like depression and PTSD, is generally not covered by most insurance companies due to its "off-label" use for mental health conditions.

Although ketamine is FDA-approved as an anesthetic, its use for psychiatric purposes lacks specific FDA approval, leading to limited insurance coverage. However, some exceptions exist, such as certain Blue Cross Blue Shield plans and veterans' benefits, which may offer coverage under specific conditions. Is Ketamine Infusion Covered by Insurance? Let's find out more.

General Coverage Overview

Insurance coverage for ketamine infusion therapy can vary widely across different insurance providers and plans. Ketamine is typically categorized as an anesthetic and has been used for decades in surgical settings, but its application as a treatment for mental health disorders is more recent. This means that many insurance companies have not yet established clear and comprehensive policies regarding its coverage in this context.

In general, health insurance providers may provide partial or no coverage for ketamine infusions when the treatment is used for conditions like depression, anxiety, or PTSD, as these are often considered "off-label" uses of the drug. Off-label use refers to the practice of prescribing a medication for conditions or in dosages that have not been specifically approved by the Food and Drug Administration (FDA). While ketamine is FDA-approved for anesthesia, its use in mental health treatment is not.

However, coverage for ketamine infusion therapy can sometimes be more likely if it is being used for certain medical conditions that are more clearly linked to its FDA-approved uses, such as chronic pain or complex regional pain syndrome (CRPS). In these cases, insurance companies may be more willing to provide coverage, though this is not always guaranteed.

Reasons for Lack of Coverage

The lack of insurance coverage for ketamine infusion therapy stems from its off-label use, limited clinical evidence, high treatment costs, varying protocols, and preference for more established, FDA-approved alternatives.

Off-Label Use

The primary reason ketamine infusion therapy is not widely covered by insurance is that it is often used off-label. While ketamine has shown promising results for treating mental health disorders, it is not FDA-approved specifically for depression, anxiety, or PTSD.

Insurance companies typically only cover treatments that are FDA-approved for the specific condition being treated. Since the FDA has not approved ketamine for psychiatric conditions, many insurance companies are hesitant to cover its infusion therapy for these purposes.

Limited Clinical Evidence

While there is growing research supporting the effectiveness of ketamine infusions for mental health conditions, especially in cases where traditional treatments have failed, insurance providers may still be skeptical.

Many insurers require substantial clinical evidence and large-scale studies before they will approve new treatments for coverage. Although studies have shown positive results, the long-term effects and overall safety of ketamine infusions remain unclear, which may lead insurers to withhold coverage until more conclusive evidence is available.

Cost of Treatment

Ketamine infusion therapy is not a one-time treatment. It typically involves multiple sessions over several weeks or months, and each infusion session can cost anywhere from $400 to $800 or more, depending on the provider and location.

| Service Type | Estimated Cost |

|---|---|

| Single Ketamine Infusion | $400 – $800 per session |

| Initial Treatment Series (6 Sessions) | $2,400 – $4,800 |

| Maintenance Infusions (Monthly/Biweekly) | $400 – $1,600 per month |

| Additional Costs (Consultations, Follow-ups, etc.) | Varies per provider |

Given these costs, many insurance companies are reluctant to cover the therapy, especially if it is considered experimental or off-label. The out-of-pocket costs for patients can be substantial, and for many, paying for the treatment out of pocket is simply not feasible.

Lack of Standardized Treatment Protocols

The treatment protocols for ketamine infusion therapy can vary widely from one clinic to another. The lack of standardization in how ketamine is administered and the doses used can create confusion for both patients and insurance companies.

Without standardized guidelines, insurers may be less willing to provide coverage, as they may not know exactly what they are paying for or how to assess the therapy's efficacy.

Alternative Treatments

Insurance companies often prefer to cover treatments that are well-established and have known efficacy rates. For conditions like depression, anxiety, and PTSD, there are many alternative treatments that are FDA-approved and are typically covered by insurance.

These treatments may include psychotherapy, antidepressants, or other forms of cognitive behavioral therapy. Because these treatments are well-documented and more widely accepted, insurance companies may prioritize them over newer or experimental treatments like ketamine infusions.

Treatment Access and Availability

Ketamine infusion therapy is not available in every region, and access to clinics that offer the treatment may be limited. In areas where there are few ketamine infusion providers, insurance companies may be less likely to cover the treatment, as it may not be considered a practical option for patients.

Also, because ketamine is often administered in specialized clinics rather than hospitals or doctor’s offices, insurers may not have established contracts with these providers, further complicating coverage.

Possible Exceptions and Avenues for Reimbursement for Ketamine Infusions

While ketamine infusion therapy is not universally covered by insurance, there are some potential exceptions and avenues that could make it more accessible for patients seeking treatment. Some insurance plans and special benefits have begun to recognize the therapeutic potential of ketamine infusions, though navigating these options can be complicated and time-consuming.

| Coverage Type | Details |

|---|---|

| Blue Cross Blue Shield (BCBS) | Some BCBS plans, like BCBS of Massachusetts, offer coverage under strict pre-authorization requirements. |

| Enthea (Employer-Sponsored Benefits) | Some employers offer Enthea, a specialized benefits program that covers ketamine infusion therapy. |

| VA Insurance (Veterans Affairs) | Veterans may be eligible for ketamine infusions through VA partnerships, particularly for PTSD and chronic pain. |

| Partial Reimbursement for Evaluation and Management (E/M) Services | Some insurers may cover doctor evaluations and management consultations even if they don’t cover the infusion itself. Patients may need to submit a superbill for reimbursement. |

Blue Cross Blue Shield (BCBS) Coverage

Certain Blue Cross Blue Shield (BCBS) plans, such as BCBS of Massachusetts (MA), have formal policies and authorization processes for covering ketamine infusion therapy. However, the process to obtain coverage through BCBS can be quite challenging.

While it is possible for some individuals to access reimbursement for their ketamine infusions, the insurer typically requires detailed documentation, a thorough assessment of the patient’s medical history, and evidence that the treatment is medically necessary.

For individuals insured by BCBS, it is crucial to begin by consulting with a healthcare provider who is familiar with ketamine therapy. The provider can help ensure that the necessary documentation is submitted to BCBS, which may include detailed records of prior treatments and evidence of treatment-resistant symptoms.

Even with this documentation, BCBS may request additional information or require patients to undergo pre-authorization before covering any part of the treatment.

Enthea and Employer-Sponsored Benefits

Another avenue for potential coverage is through Enthea, a benefits program available through certain employer-sponsored health plans. Enthea offers coverage for ketamine infusions and ketamine-assisted therapy as part of a broader wellness package.

The program aims to expand access to psychedelic-assisted treatments, such as ketamine therapy, for individuals with mental health conditions like depression, anxiety, and PTSD.

Enthea provides an alternative to traditional insurance by offering coverage as a special benefit for employees. However, this program is only available through specific employers who have partnered with Enthea to offer these benefits to their workforce.

If an individual works for an employer who provides Enthea coverage, they may have access to ketamine infusion therapy without needing to jump through the hoops of traditional insurance companies. However, like with BCBS, there may still be limitations and eligibility requirements that need to be met.

Partial Reimbursement for Evaluation and Management

In some cases, even if ketamine infusion therapy itself is not covered, certain components of the treatment process might be reimbursed. One of the most common areas of reimbursement is the "evaluation and management" (E/M) portion of the appointment. This refers to the healthcare provider’s time spent assessing the patient’s symptoms, medical history, and overall treatment plan.

For some insurance policies, the evaluation and management services are eligible for reimbursement, even if the actual ketamine infusion therapy is not covered. This can be a useful avenue for patients who may only need a partial reimbursement to offset the cost of the therapy.

However, reimbursement for E/M services is not guaranteed, and patients should check with their insurance provider to understand the specifics of what can be reimbursed. The reimbursement process may involve submitting a "superbill" (an itemized bill that includes relevant medical codes), which the patient can then submit to their insurance company for partial reimbursement.

VA Insurance and Coverage for Veterans

Veterans seeking ketamine infusion therapy may have more options for coverage through the U.S. Department of Veterans Affairs (VA). The VA has partnered with specialized clinics to offer ketamine therapy to veterans. These partnerships are aimed at helping veterans with conditions like chronic pain, PTSD, and depression—conditions where ketamine has shown promise as an alternative or adjunctive treatment.

Veterans may be eligible for coverage through VA insurance for ketamine infusions, depending on the specific criteria set by the VA and the partnership with PMC.

Veterans should first reach out to their VA health care provider to discuss whether ketamine therapy is an appropriate treatment option for them. If approved, the VA may cover some or all of the treatment costs, though veterans should be aware that this option may not be available in all locations or for all conditions.

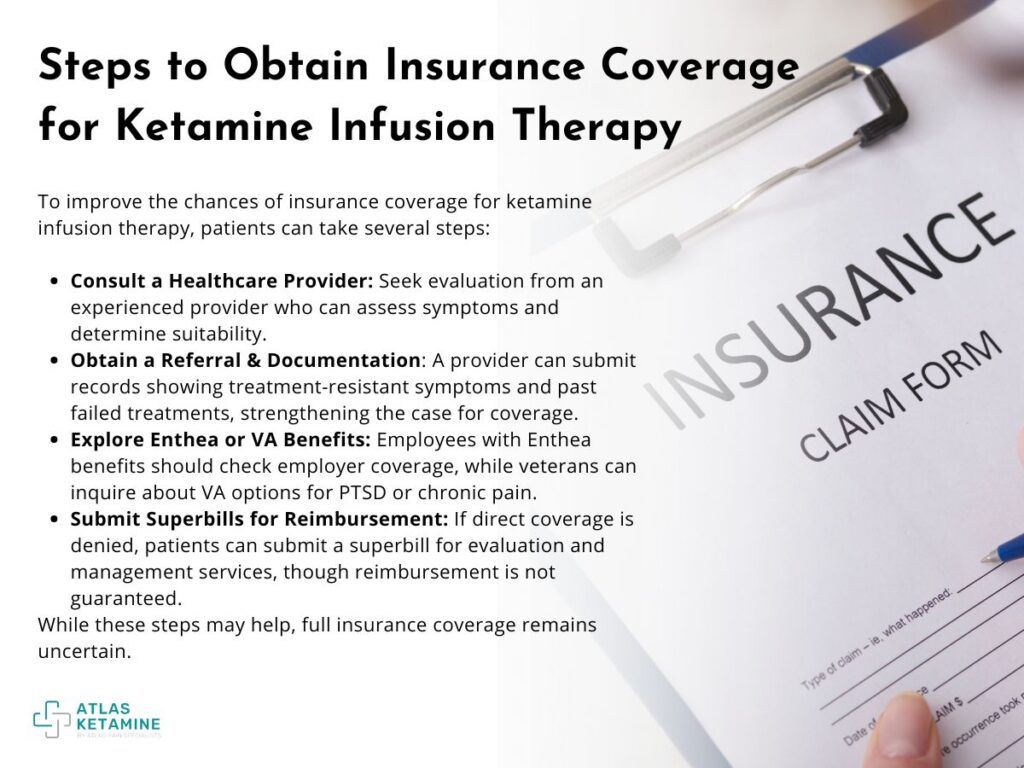

Steps to Potentially Obtain Coverage

For patients looking to obtain insurance coverage for ketamine infusion therapy, there are several steps they can take to improve their chances of reimbursement, though it is important to keep in mind that full coverage is not guaranteed. Here are some key steps to consider:

- Consult with a Healthcare Provider: The first step is to consult with a healthcare provider experienced in ketamine infusion therapy. The provider can assess the patient’s symptoms, review their treatment history, and determine if ketamine infusions are a suitable option. This is a critical step, as most insurance companies will require a thorough evaluation and medical documentation before approving any treatment.

- Obtain a Referral and Detailed Documentation: If a healthcare provider determines that ketamine therapy is appropriate, they can provide a referral and submit detailed documentation to the insurance company. This may include medical records that show treatment-resistant symptoms, such as a history of unsuccessful attempts with other therapies, including medication and psychotherapy. The more thorough and compelling the documentation, the better the chances of receiving some level of coverage.

- Explore Enthea or VA Benefits: If the individual is employed by a company that offers Enthea benefits, they should explore whether ketamine therapy is covered as part of their employer-sponsored health plan. Veterans should consult with their VA healthcare provider to inquire about coverage options through the VA, particularly if they are dealing with chronic pain or mental health conditions like PTSD.

- Submit Superbills for Partial Reimbursement: If the insurance company denies coverage for the ketamine infusion itself, patients may still be able to receive partial reimbursement for the evaluation and management services associated with the treatment. In these cases, patients can submit a superbill to their insurer, which details the medical services provided and associated costs. However, reimbursement for E/M services is not guaranteed, and patients should be prepared for the possibility of no reimbursement.

Does Insurance Cover Ketamine Infusions

Insurance coverage for ketamine infusions remains limited due to their off-label use for mental health conditions. While some exceptions exist, such as coverage for veterans through VA insurance, most patients face out-of-pocket costs.

Advocacy efforts are underway to improve coverage, highlighting the treatment's efficacy for conditions like depression and PTSD. As the medical community continues to push for broader acceptance, patients must navigate complex insurance policies and seek alternative financial options to access this potentially life-changing therapy.